change in net working capital formula

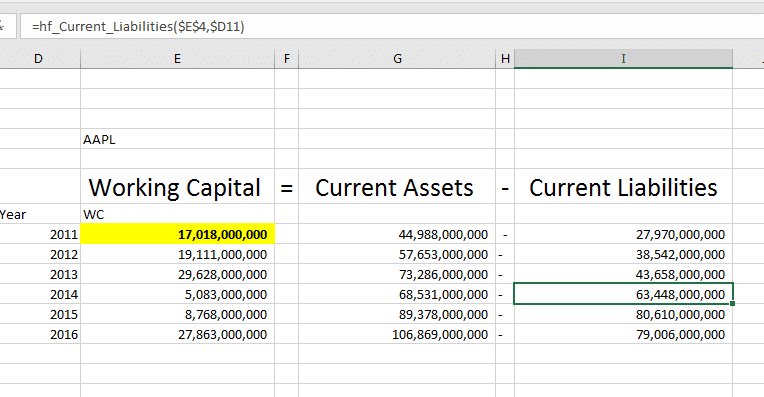

Change in Working capital does mean actual change in value year over year ie. Computing the net working capital helps to measure and keep track of the financial status of the company.

Net Working Capital Template Download Free Excel Template

Most small businesses do not need to adjust the standard formula.

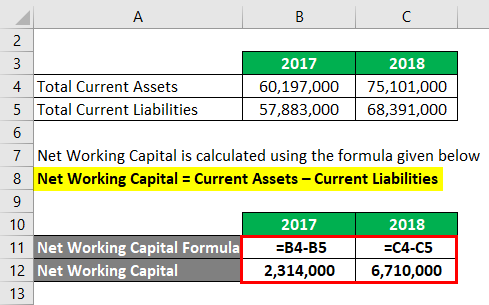

. The formula to calculate the change in the net working capital is as follows. As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. For the year 2019 the net working capital was 7000 15000 Less 8000.

Changes in the Net Working Capital Net Working Capital of the Current Year Net Working Capital of the Previous Year. Now changes in net working capital are 3000 10000 Less 7000. The following example illustrates how to calculate net working capital and what it may mean for a business.

Changes In Net Working Capital. Changes in the Net Working Capital Change in Current Assets Change in the Current Liabilities. Thats why the formula is written as - change in working capital.

It means the change in current assets minus the change in current liabilities. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. Lets understand how to calculate the Changes in the Net Working Capital with the help of an example.

Heres a couple examples. Wc changes in working capital. When using the formula to understand cash changes.

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. Net working capital ratio is found by dividing current assets by current liabilities. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value.

Change in Net Working Capital 12000 7000. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Since the change in working capital is positive you add it back to Free Cash Flow.

Change in NWC Formula. Determine whether the cash flow will increase or decrease based on the needs of the business. For year 2020 the net working capital is 10000 20000 Less 10000.

Net Working Capital Example. The change in net working capital formula is defined by subtracting the ending and beginning NWC. The net working capital ratio measures the proportion of a businesss short-term net cash to its assets.

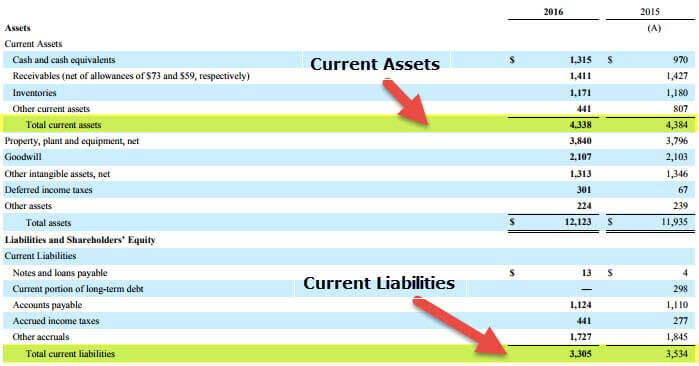

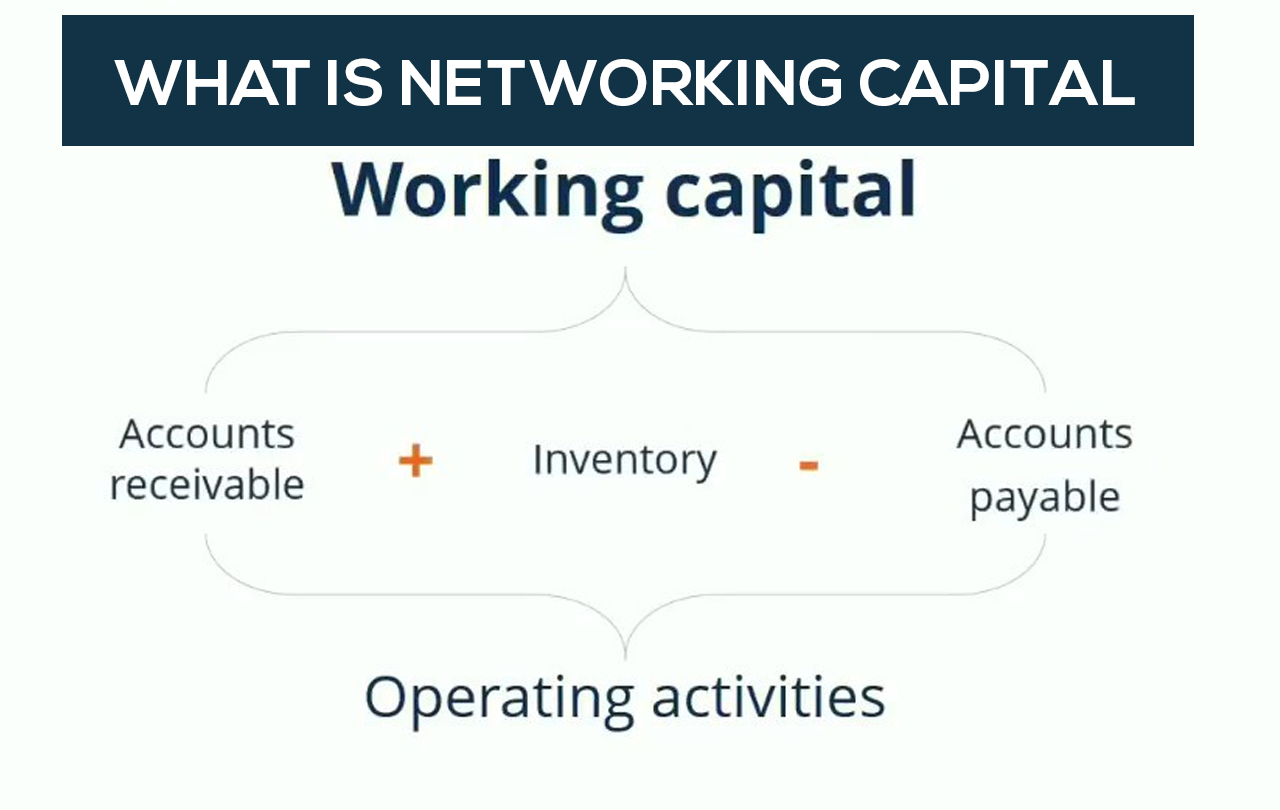

The change in net working capital can show you if your short-term business assets are increasing or decreasing in relation to. The change in net working capital nwc section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Current assets current liabilities.

Current assets are referred to the assets that can be converted into cash within a years time period. Net Working Capital Current Assets Current Liabilities. Refer the above given online calculator to calculate change in NWC in dollar.

Changes in the Net Working Capital Formula. ABC Company has cash of 30000 accounts receivable of 50000 inventory of 70000 and long-term fixed assets of 500000. You should exclude cash cash equivs.

Change in Net Working Capital 5000. Changes in net working capital can be calculated by subtracting the previous years net working capital from the current years. The goal is to.

For cash purposes you need to think about the change in Working Capital. Say that your company has cash that equals 25000 accounts receivable of 10000 and total inventories worth 20000. Change in Net Working Capital is calculated using the formula given below.

You can use the following formula for calculating NWC ratio. Current assets - current liabilities and expenses total assets. The Net Working Capital Formula is.

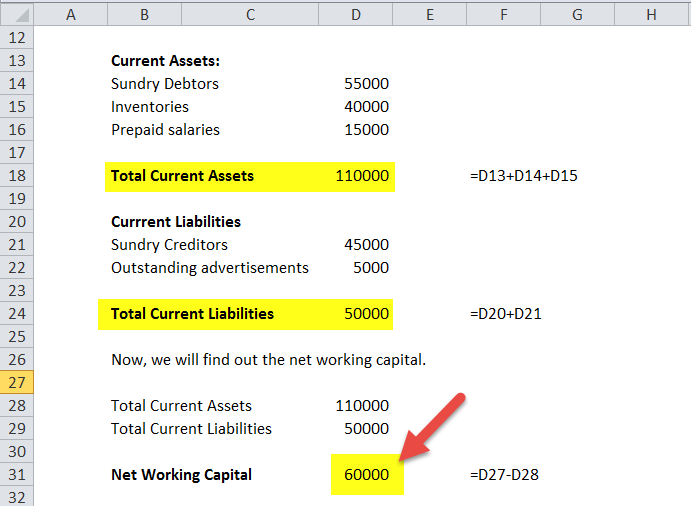

Current assets can be Cash Sundry debtors Inventory Accounts receivables etc. When you apply for a line of credit lenders will consider the overall health of your balance sheet including your working capital ratio net working capital annual revenue and other factors. Add or subtract the amount.

Total Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. Net Working Capital Formula. To calculate the change you need to determine the net working capital for both the current and previous period and heres the formula.

So if the company somehow classifies these items within. So in your example if nothing changed except your AR increased by 10 bucks yes your Net Working Capital is higher. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period.

Working Capital Current Assets Current Liabilities. If your working capital ratio is below 1 it may indicate a company is in a risky position. The Net Working Capital formula can be broken down into two components.

The first component of the Net Working Capital formula is Current assets. Total current liabilities Sundry Creditors Outstanding advertisements 45000 5000 50000. Net working capital ratio.

Change in Net Working Capital NWC Prior Period NWC Current Period NWC. You can find the net working ratio with this simple calculation. However to check the change in cash you subtract the increase in NWC for.

Change in net working capital net working capital for current period net working capital for previous period Take a look at the table above again we can calculate the Change in Net Working Capital of the firm. To present it mathematically Changes in Net Working Capital Net Working Capital of Current Year. Now that you understand the equation and what common types of current assets and liabilities are here is an example of how the NWC ratio works.

The following information was obtained from a companys income statement and balance sheet for 2018 and 2019. Net Working Capital Ratio Current assets Current Liabilities. To calculate the total current assets you need to.

The Net Working Capital Formula and the Working Capital Ratio Formula are the easiest ways to determine whether your business has the cash flow necessary to meet your debt and operational demands over the next year. Net working capital for the current period net working capital for the previous period change in net working capital. In this case the change is positive or the current working capital is more than the last year.

Calculate the change in working capital. Net working capital example. The net working capital formula is calculated by subtracting the current liabilities from the current assets.

What is Financial Modeling Financial modeling is performed in Excel to forecast a. Net Working Capital Current Assets less cash Current Liabilities less debt or.

Net Working Capital Definition Formula How To Calculate

Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Is A House An Asset Or Liability Online Accounting

Change In Net Working Capital Nwc Formula And Calculator

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Formula Calculator Excel Template

Net Working Capital Definition Formula How To Calculate

Net Working Capital Definition Berechnung Beispiel Mit Video

10 Of 14 Ch 10 Change In Net Working Capital Nwc Explained Youtube

Changes In Net Working Capital All You Need To Know

Net Working Capital Definition Formula How To Calculate

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital How To Interpret And Calculate In Excel With Marketxls

A Complete Guide To Net Working Capital And How To Calculate It

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)